Washington Paid Sick Leave Law – Impacts of Initiative 1433

Initiative 1433, approved by Washington voters in Fall 2016, contains four primary changes to State law:

- Requires all employers (even under 50 employees) to provide paid sick leave to most employees beginning January 1, 2018.

- There are 16 exemptions to employees entitled to receive sick leave. (See RCW 49.46.010(3)).

- Increases the minimum wage over the next several years.

- Ensures tips and service charges are given to the appropriate staff.

- Protects employee from retaliation when exercising their rights under the Minimum Wage Requirements and Labor Standards Act.

- Requires written policies for optional shared leave, frontloaded paid sick leave, a different accrual year or a PTO program.

Paid Sick Leave Requirements

Accrual

- Most employees must accrue paid sick leave at a minimum rate of 1 hour of paid sick leave for every 40 hours worked including overtime. This includes part-time and seasonal workers.

- Paid sick leave must be paid to employees at their normal hourly compensation.

- Employers must allow employees to use paid sick leave in increments consistent with the employer’s payroll system and practices, not to exceed one hour. For example, if an employer’s normal practice is to track increments of work for the purposes of compensation in 15-minute increments, then an employer must allow employees to use paid sick leave in 15-minute increments.

- Accrued and unused paid sick leave of 40 hours or less must be carried over to the following year. o Employers are allowed to provide employees with more generous carry over and accrual policies.

- If an employer chooses to reimburse an employee for any portion of their accrued, unused paid sick leave at the time the employee separates from employment, any such terms for reimbursement must be mutually agreed upon in writing by both the employer and the employee, unless the right to such reimbursement is set forth elsewhere in state law or through a collective bargaining agreement and should be consistently applied.

- An employer must reinstate the employee’s previously accrued, unused and unpaid out paid sick leave, if it rehires an employee within 12 months of separation.

Usage

- Employees may use paid sick leave: o To care for themselves or their family members.

- When the employees’ workplace or their child’s school or place of care has been closed by a public official for any health-related reason.

- For absences that qualify for leave under the state’s Domestic Violence Leave Act.

- Employers may allow employees to use paid sick leave for additional purposes.

- Employees are entitled to use accrued paid sick leave beginning on the 90th calendar day after the start of their employment.

- Employers must provide a one-time notification to each employee of their paid sick leave rights.

- Not less than monthly an employer must provide notification to its employee detailing: the amount of paid sick leave accrued since notification was made last, the amount used and the total amount unused. QuickBooks can track this and it may be shown on an Employee’s paystub.

Rulemaking for paid sick leave

The Department of Labor & Industries (L&I) has been developing rules to explain and enforce the new requirements. Learn more about paid sick leave rulemaking (lni.us.engagementhq.com).

Optional Sample Policies

While employers don’t need to have a written paid sick leave policy to be in compliance with L&I’s paid sick leave rules, it’s a best practice to have one so that both employees and employers have a shared understanding of their rights and obligations.

The paid sick leave administrative rules do require an employer to maintain a written policy or collective bargaining agreement if they want to apply specific requirements or elements for their company, such as reasonable notice, a shared leave program or verification requirements.

Coming soon to the L&I Web page listed above are basic sample:

Paid Sick Leave Policy Reasonable Notice Policy

Verification Policy Shared Leave Policy

Frontloading Policy

The information contained herein is condensed and informational only. All employers should speak to their legal counsel to ensure their policies are in line with the Initiative requirements.

Payroll and Recordkeeping Requirements

If you use QuickBooks for your payroll, it has the ability to accrue sick time. If you would like Cordell, Neher & Company, PLLC to set up the recordkeeping for you, please contact Jennifer Babcock of our Firm at 509-663-1661 or jennifer@cnccpa.com.

If you would like to set up QuickBooks to properly accrue the 1 hour of sick leave per 40 hours worked, the instructions are listed below:

If you would like to set up QuickBooks to properly accrue the 1 hour of sick leave per 40 hours worked, the instructions are listed below:

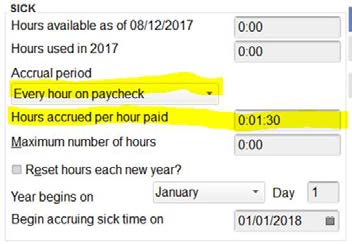

- Go into the employee’s payroll set up window and click on the Payroll Info tab.

- Click the Sick/Vacation button.

- In the window that pops up, select “Every hour on paycheck” under the sick accrual period section.

- In the “Hours accrued per hour paid” field, enter 0:01:30 (see below).

- This accrues 1.5 minutes for each hour worked, or one hour for 40 hours worked.

- Select 1/1/18 as your accrual start date.

Should you have additional questions on recordkeeping or tracking, please feel free to call Pete Luchini, CPA or Jennifer Babcock, CPA of our Firm.

Events & Deadlines

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee, United StatesCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2020 Cordell, Neher & Company PLLC • Designed by Pixel to Press