Philanthropy and Millennials

Kris Loomis

By Kristine Loomis, CPA, CVA, Cordell, Neher & Company, PLLC, Wenatchee Certified Public Accountant

December is a month where many focus on charitable giving as they look for year-end tax deductions and share with others as part of their holiday celebrations. With so much attention on millennials, we thought we would share the findings of a recent study regarding millennials and their approach to philanthropy. Spoiler alert: The future looks bright!

A recent study commissioned by Dunham+Company and conducted by Campbell Rinker found that millennials are increasing their donations and charitable commitments as they get older and settle into their communities.

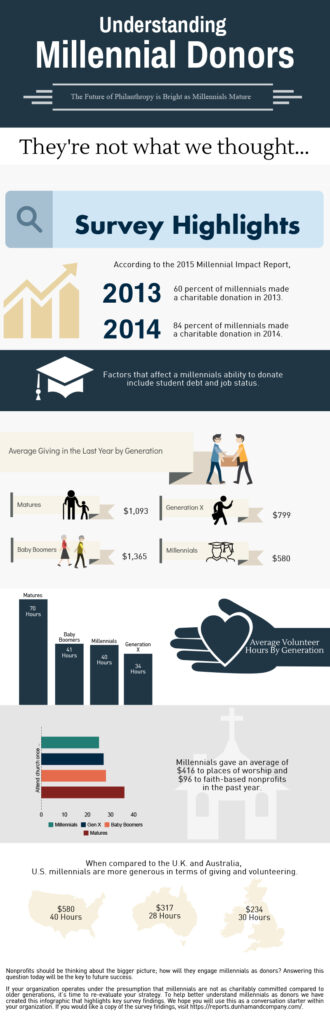

Survey Highlights

Millennials, those born between 1984 and 2000, have become the focal point for many nonprofit organizations. According to 2015 U.S. census data, millennials are the largest generation, representing more than one quarter of the nation’s population. Currently, they are responsible for 11% of charitable donations, a figure that is projected to grow as this generation matures.

In the past year, Millennials gave less to charity than the other more mature generations (Gen Xers, baby boomers and traditionalists). However, their behavior paints a more generous picture. According to the survey, millennials averaged 40 volunteer hours in the past year. These statistics closely reflect Gen Xers and baby boomers, leading us to presume that millennials are more engaged than we assume.

- The following survey highlights give us even more reason to be optimistic about the future of philanthropy as millennials mature.

- The top three types of charities millennials support include places of worship, faith-based nonprofits and education. Volunteerism and attending religious services are two key indicators of a person’s willingness to give to a charity. The takeaway: Personal spirituality plays a very important role in the life of U.S. donors.

- 51% of millennials have given a gift through a charity’s website and 69% of millennials indicate they plan to do so in the future. The takeaway: Nonprofit organizations would be wise to make this online process seamless for millennials who appear quite willing to donate through websites and other electronic means.

- Millennials are influenced by their peers on social media to donate. The takeaway: Requests for donation don’t always come directly from organizations. Millennials deviate from the altruism of the past thanks to peer pressure philanthropy.

- Millennials agreed with the sentiment that charities are more effective than government in providing important services. The takeaway: Millennials recognize the importance of nonprofit objectives.

- 72% of U.S. millennial donors indicated that they are more likely to give when their gift will be matched or multiplied. The takeaway: Nonprofits (or companies wishing to encourage philanthropy) should consider offering an incentive to attract and encourage millennial donors.

- In the past 12 months, U.S. millennial donors gave $580 to non-church charities. This is 147% more than millennials in the U.K. and 83% more than Australian millennials. The study revealed similar results when comparing volunteer hours. U.S. millennials volunteered 40 hours last year compared to U.K. millennials with 30 hours and Australian millennials with 28 hours. The takeaway: U.S. millennials are more generous when compared to the millennials of other countries.

The primary takeaways of the research suggest nonprofits should be thinking about the bigger picture and asking themselves how they will engage millennials as donors. Recognizing that millennials appear to be more willing to donate time could be helpful in tapping into this large group. Determining now how to interest millennials in your cause and how they can provide both volunteer support as well as monetary support will be the key to future success.

If your organization operates under the presumption that millennials are not as charitably committed compared to older generations, it is time to re-evaluate your strategy. To help better understand millennials as donors we have created an infographic that highlights key survey findings. Using this as a conversation starter within your organization may be helpful. If you would like a copy of the survey findings, visit https://reports.dunhamandcompany.com/.

Kristine Loomis is a Certified Public Accountant with Cordell, Neher & Company, PLLC, a Wenatchee public accounting firm. She may be reached at 509-663-1661 or kris@cnccpa.com. www.cnccpa.com

Events & Deadlines

Community Service Day

Cordell Neher & Company, PLLC 175 E Penny Rd #1, Wenatchee, United StatesCNC Newsletter

Subscribe and stay informed on policy changes that could have an impact on you.

Footer Contact

Check the background of your financial professional on FINRA's BrokerCheck®

Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor. Cordell, Neher & Company, PLLC makes every attempt to ensure that the information contained on their websites are obtained from reliable sources, but is not responsible for any errors and/or omissions or from the results obtained from the use of any information. This site contains links to servers maintained by other organizations. Cordell, Neher & Company, PLLC cannot provide any warranty regarding the accuracy or source of information found on any of these servers, the content of any file the user might use to download from a third-party site, and is not responsibility for the content found on any of these servers or for any links these servers maintain with other servers.

Avantax affiliated advisors may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment ServicesSM, Member FINRA, SIPC, Investment Advisory services offered through Avantax Advisory ServicesSM,Insurance services offered through an Avantax affiliated insurance agency. 3200 Olympus Blvd., Suite 100 Dallas, TX 75019 972-870-6000.

Avantax financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state. Securities offered through Avantax Investment Services.SM, Member FINRA, SIPC. Investment Advisory Services offered through Avantax Advisory Services SM. Insurance services offered through an Avantax affiliated insurance agency. Method 10® is property of Avantax Wealth Management.SM All rights reserved 2020. The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business. This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

The Avantax family of companies exclusively provide financial products and services through its financial representatives. Although Avantax Wealth ManagementSM does not provide or supervise tax or accounting services, Avantax Representatives may offer these services through their independent outside business. Content, links, and some material within this website may have been created by a third party for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth ManagementSM or its subsidiaries. Avantax Wealth ManagementSM is not responsible for and does not control, adopt, or endorse any content contained on any third party website.

This information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Investments & Insurance Products: Are not insured by the FDIC or any federal government agency- Are not deposits of or guaranteed by the bank or any bank affiliate- May lose Value

Avantax Investment ServicesSM and Avantax Advisory ServicesSM are not affiliated with CNC Financial Group, LLC.

© 2020 Cordell, Neher & Company PLLC • Designed by Pixel to Press